Modern Portfolio Theory: The Science of Diversification

Modern Portfolio Theory: The Science of Diversification

In 1952, Harry Markowitz published a paper that changed finance forever. He proved that high returns aren't just about picking the best stocks; they are about picking the best combination of stocks to minimize risk. This concept earned him a Nobel Prize and is known as Modern Portfolio Theory (MPT).

MPT argues that investors are risk-averse. Given two portfolios that offer the same expected return, investors will prefer the less risky one.

This guide explores how to optimize your asset allocation using MPT principles.

1. Risk and Correlation

The "free lunch" of diversification relies on Correlation.

- Correlation of +1: Assets move identically. (e.g., Google and Microsoft).

- Correlation of -1: Assets move oppositely. (e.g., Airline Stocks vs. Oil Prices).

- Correlation of 0: No relationship. (e.g., Bitcoin vs. Corn Futures).

The MPT Magic: If you combine two risky assets that are imperfectly correlated (correlation < 1), the risk of the portfolio is lower than the weighted average risk of the individual components. You reduce volatility without necessarily sacrificing returns.

2. The Efficient Frontier

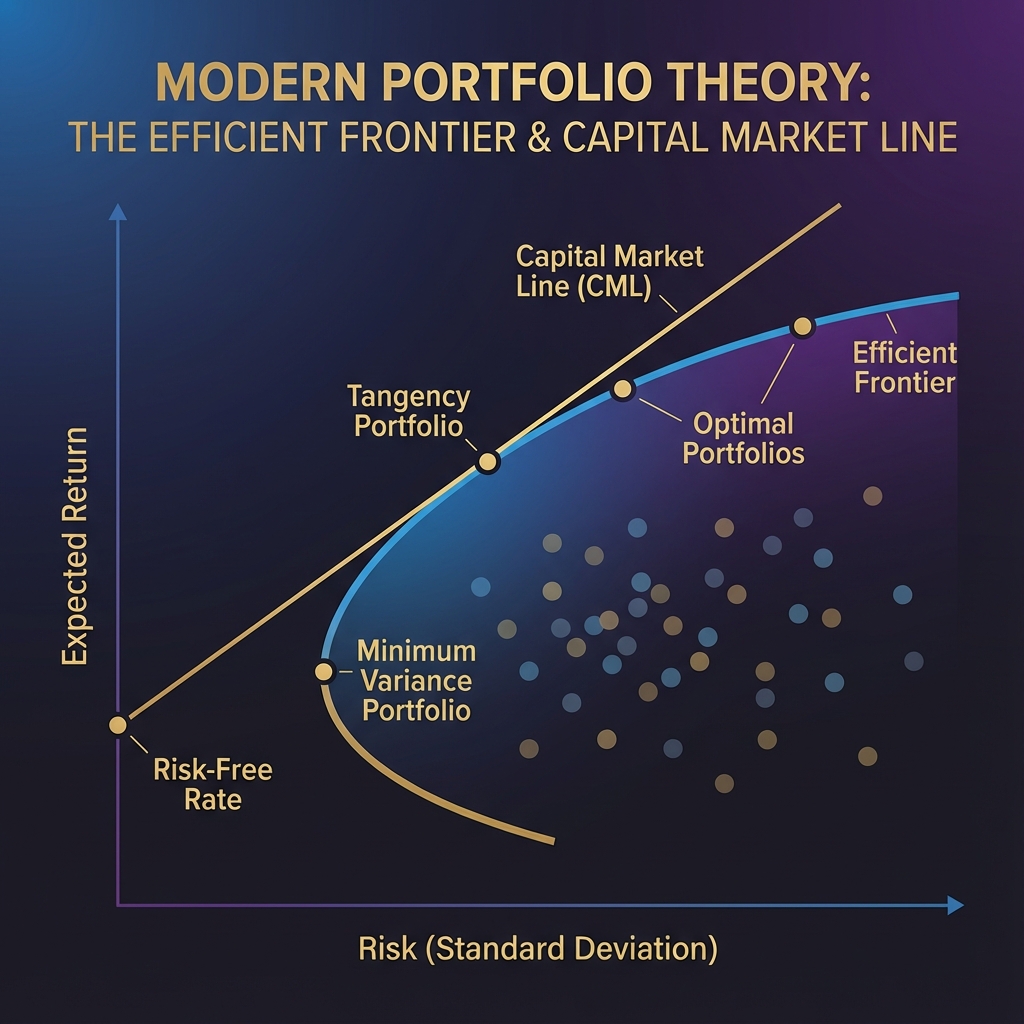

Imagine plotting every possible combination of assets on a graph where:

- X-Axis: Risk (Standard Deviation).

- Y-Axis: Expected Return.

There is a curved line that represents the maximum possible return for a given level of risk. This line is called the Efficient Frontier.

- Below the line: Inefficient. You are taking too much risk for too little return.

- On the line: Optimal.

- Above the line: Impossible (without leverage).

Your goal as an investor is to build a portfolio that sits on the Efficient Frontier.

3. Key Metrics of MPT

A. Beta ($\beta$)

Beta measures an asset's volatility in relation to the overall market (S&P 500).

- Beta = 1: Moves with the market.

- Beta > 1: More volatile (High Tech, Growth).

- Beta < 1: Less volatile (Utilities, Staples).

- Beta < 0: Inverse correlation (Gold often, or Short ETFs).

B. Alpha ($\alpha$)

Alpha is the excess return of an investment relative to the return of a benchmark index. It measures the "skill" of the manager.

- Formula:

Return - (Risk Free Rate + Beta * Market Return)

C. Sharpe Ratio

The most famous risk-adjusted metric.

- Formula:

(Portfolio Return - Risk Free Rate) / Standard Deviation. - Meaning: How much return are you getting per unit of risk?

- Target: > 1.0 is good. > 2.0 is excellent. > 3.0 is legendary.

4. Asset Allocation Models

The 60/40 Portfolio (The Classic)

- Allocation: 60% Stocks, 40% Bonds.

- Logic: Stocks provide growth; bonds provide income and stability during crashes.

- Critique: In a low-interest-rate world, bonds may not provide enough cushion.

The All-Weather Portfolio (Ray Dalio)

Designed to perform well across four economic environments: Inflation, Deflation, Growth, and Recession.

- 30% Stocks (Growth)

- 40% Long-Term Treasuries (Deflation hedge)

- 15% Intermediate Treasuries

- 7.5% Gold (Inflation hedge)

- 7.5% Commodities (Inflation hedge)

The Endowment Model (Yale Model)

Favors high allocation to alternative assets.

- Public Equities: low allocation.

- Private Equity / Venture Capital: high allocation.

- Real Assets (Timber, Real Estate): moderate allocation.

- Logic: Harvest the "illiquidity premium."

5. Rebalancing: The Disciplined Buy Low, Sell High

MPT requires maintenance. If your stocks double, your portfolio might drift from 60/40 to 80/20. Now you are taking too much risk.

- Rebalancing involves selling the winner (Stocks) and buying the loser (Bonds) to get back to 60/40.

- This forces you to mechanically "sell high and buy low" without emotional interference.

Conclusion

Modern Portfolio Theory teaches us that Risk is not just a number—it is a currency. You spend risk to buy returns. By understanding correlation and the efficient frontier, you can ensure you are getting the best exchange rate possible for your risk budget.

Disclaimer: Past performance of asset classes does not guarantee future results.